They do not own or take a position in the underlying asset. Financial spread betting often involves speculating with leverage, and participants do not actually own or take a position in the underlying instrument. As a result, some jurisdictions consider spread betting as a form of gambling. However, experienced traders can also use spread betting as an informed hedging strategy along with more traditional investments.

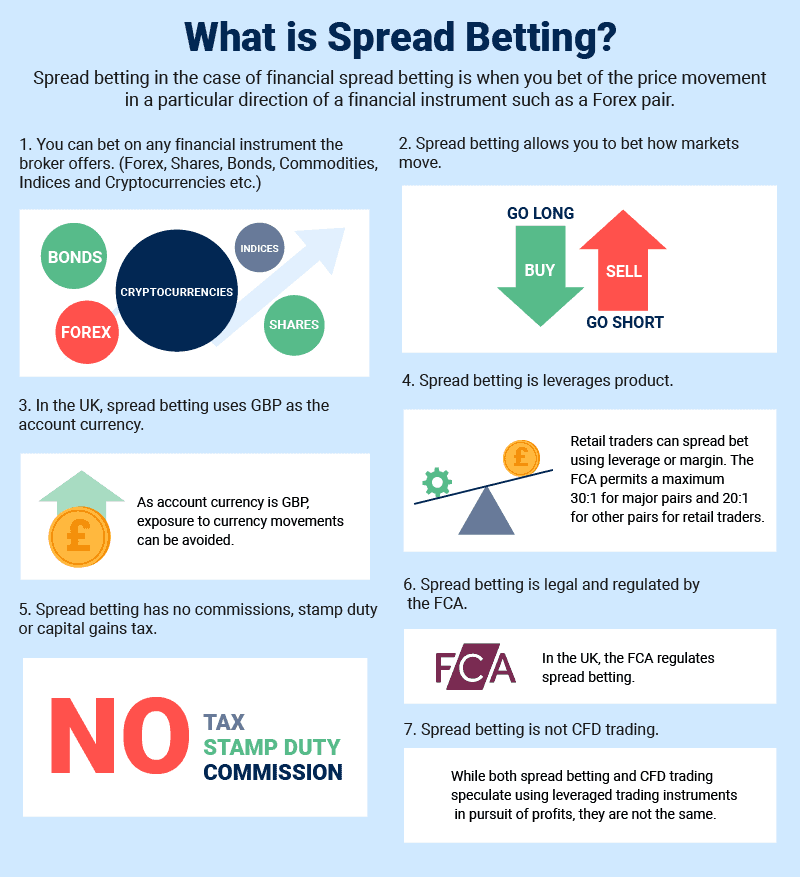

Spread betting can be done with a variety of financial instruments, including commodities, indices, shares, and forex. Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry for some investors and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets. The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

It is important to note, however, that spread betting is illegal in the United States. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page.

These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes. Table of Contents Expand. Table of Contents. What Is Spread Betting? How It Works.

Pros and Cons. Managing Risk. The Bottom Line. Trading Options and Derivatives. Trending Videos. Key Takeaways Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security.

Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U. Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

Despite its American roots, spread betting is illegal in the United States. What Is Financial Spread Betting? Is Financial Spread Betting Gambling? What Types of Investment Assets Can You Use With Spread Betting? Compare Accounts.

Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Related Articles. Partner Links. Related Terms. Spread Betting: What It Is and How It Works Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Arbitrageur: Definition, What They Do, Examples An arbitrageur is an investor who tries to profit from price inefficiencies in a market by making two simultaneous offsetting trades or from price differences during mergers. Futures Contract Definition: Types, Mechanics, and Uses in Trading A futures contract is a standardized agreement to buy or sell the underlying commodity or other asset at a specific price at a future date.

close ; } } this. getElementById iframeId ; iframe. max contentDiv. scrollHeight, contentDiv. offsetHeight, contentDiv. document iframe. Purchase options and add-ons. El método más eficaz y preciso para analizar un spread.

Lo que aprenderás leyendo " Commodity Spread Trading - El método correcto de análisis ": el estudio de la estacionalidad; el análisis fundamental; el análisis de la estructura temporal; distribución del contango; posición neta COT; cómo operar con las anomalías y; otros aspectos importantes a través de varios ejemplos.

Report an issue with this product. Previous page. Print length. Publication date. See all details. Next page. About the author Follow authors to get new release updates, plus improved recommendations.

David Carli. Brief content visible, double tap to read full content. Full content visible, double tap to read brief content. Read more Read less.

Customer reviews. How customer reviews and ratings work Customer Reviews, including Product Star Ratings, help customers to learn more about the product and decide whether it is the right product for them.

Learn more how customers reviews work on Amazon. Images in this review. Sort reviews by Top reviews Most recent Top reviews. Economic Diary. Financial Trading Blog. Weekly Trading Update. Spreadex Market Update. Weekly Technical Analysis. Latest Promotions.

Education Hub. Our Platforms. Spread betting glossary. Account Information. Payment Information. Technical Information. ESMA Ruling FAQs. com Financials Education Hub What is Spread Betting? What is Spread Betting? An Introduction to Spread Betting Spread betting is a popular and versatile trading method that allows investors to speculate on the price movements of various financial instruments, such as shares, indices, currencies, commodities, and more.

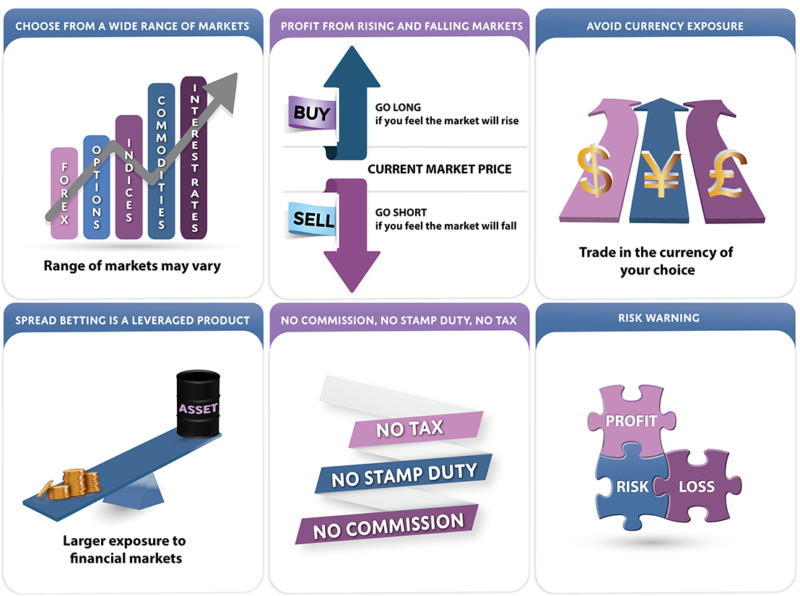

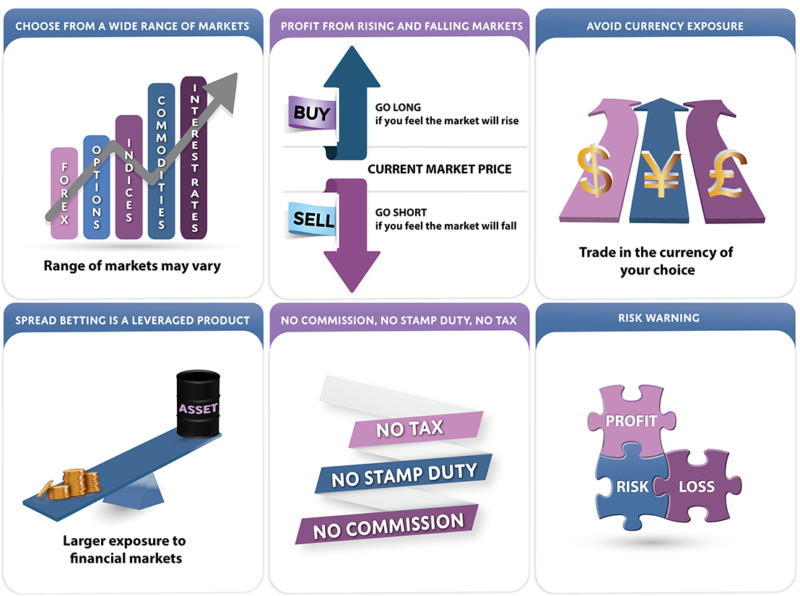

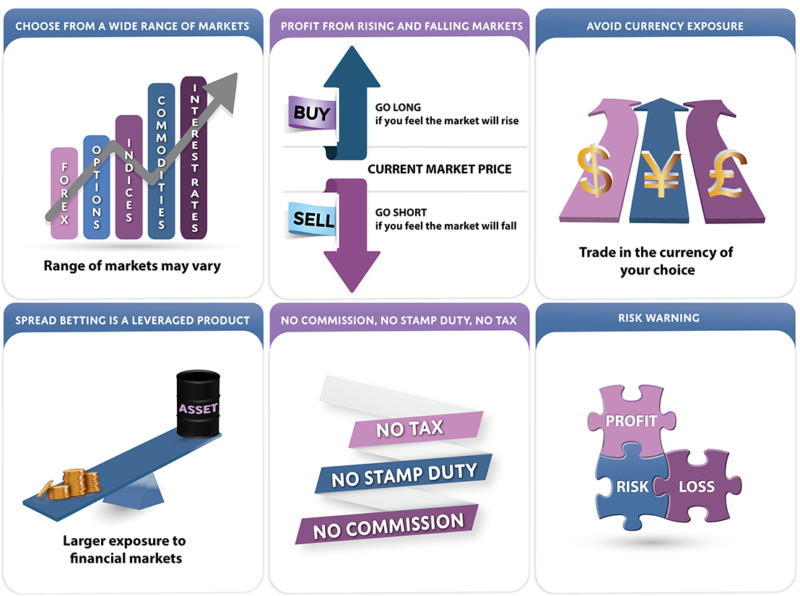

The Basics And Benefits At its core, spread betting involves placing a bet on the direction of a market's price movement without actually owning the underlying asset. Go Long and Go Short : Potential to profit from both rising and falling markets, increasing trading opportunities.

Trade With Leverage : Trade with a smaller initial deposit for a large position. No Commission : There is no commission to pay on a spread bet since costs are built into the spread.

Key Components of a Spread Bet To fully understand spread betting and make informed trading decisions, it's essential to grasp the key components of a spread bet. What is the Spread? STAKE In spread betting, "stake" refers to the amount of money you wager per unit of movement in the underlying market.

Margin Margin is the amount of capital required in your account to support your leveraged positions. Going Long and Short As we know the markets can rise and fall and as a trader you can capitalise on both these directions. Opening and Closing Orders An opening order An instruction to initiate a new position in a financial instrument.

It is used to enter a trade and take a position in the market. There are two common types of opening orders: a market order, and a limit order. Market order An instruction to buy or sell a at the current market price. When a market order is placed, it is executed immediately at the prevailing market price.

Market orders ensure quick execution but do not guarantee a specific price. A limit order An instruction to buy or sell at a specific price or better.

If the market reaches the limit price, the order is executed at the desired price or a better one. Timeframes and Expiry Dates Spread bets can be placed over various timeframes, from intraday trades to long-term positions. Advantages of Spread Betting Spread betting offer several advantages for traders.

Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x

Métodos de spread betting - Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x

You can see how this works in practice via the below example of a financial spread bet on a share price as well as examples on other markets using the tabs below. Spread betting offer several advantages for traders.

Some advantages include tax efficiency, margin trading and access to multiple markets. Terms and Agreements Risk Notice Sitemap Contact Us Spreadex Social Media Mobile Site Careers. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Log In. Sign Up. CREATE AN ACCOUNT. Get Started. Economic Diary. Financial Trading Blog. Weekly Trading Update. Spreadex Market Update. Weekly Technical Analysis. Latest Promotions. Education Hub. Our Platforms.

Spread betting glossary. Account Information. Payment Information. Technical Information. ESMA Ruling FAQs. com Financials Education Hub What is Spread Betting? What is Spread Betting? An Introduction to Spread Betting Spread betting is a popular and versatile trading method that allows investors to speculate on the price movements of various financial instruments, such as shares, indices, currencies, commodities, and more.

The Basics And Benefits At its core, spread betting involves placing a bet on the direction of a market's price movement without actually owning the underlying asset. Go Long and Go Short : Potential to profit from both rising and falling markets, increasing trading opportunities.

Trade With Leverage : Trade with a smaller initial deposit for a large position. No Commission : There is no commission to pay on a spread bet since costs are built into the spread.

Key Components of a Spread Bet To fully understand spread betting and make informed trading decisions, it's essential to grasp the key components of a spread bet. What is the Spread? STAKE In spread betting, "stake" refers to the amount of money you wager per unit of movement in the underlying market.

Margin Margin is the amount of capital required in your account to support your leveraged positions. Going Long and Short As we know the markets can rise and fall and as a trader you can capitalise on both these directions. You might need to become familiar with the type of market you could decide to partake in.

You could become knowledgeable in various ways, such as looking at economic data and events, any important economic announcements that are known to move the market, and through chart review.

This is particularly helpful, as you could review recent and historical price movements. Spread betting offers numerous benefits for individuals seeking to participate in financial markets. Spread betting is only available to residents of the UK and Ireland.

Yes, spread betting is only available for residents of the UK and Ireland. This will depend on the broker you use. Every broker has their own deposit amount to start spread betting.

Depositing more than the minimum is wise to keep your account active. Conducting thorough research with a comprehensive understanding of spread betting with leverage might be essential while developing a robust risk management strategy.

With that said, you could deposit more funds than required and bet with a tight stop-loss to limit the risk of losing. To hedge in spread betting, you should open a position in the opposite direction to counterbalance negative price movements.

What can I spread bet on? You have a variety of markets to choose from with spread betting; these include:. Could I profit from spread betting? Yes, you could stand to profit only if your prediction of the market is correct. What is the difference between spread betting and CFDs? How are spread bets taxed?

For the UK and Ireland, spread bets are tax-free. With that said, tax laws can change and will also depend on individual circumstances. Part-time to Pro 11 MIN READ. Spread betting — What is it and how does it work?

Key Features Spread betting allows traders to speculate on rising and falling markets for various financial instruments without owning the underlying asset.

Stamp-duty is not applicable on these trades. Spread betting uses leverage, allowing traders to participate in the market with larger positions, magnifying potential profits and losses. The spread in spread betting refers to the difference between the bid sell price and the ask buy price; this amount can vary depending on factors such as market conditions.

The bet size is the amount of money you allocate towards a trade with a per-point movement in the market, which will help calculate the potential profits or losses. Bet durations are the time from opening and closing a position; you could close a position anytime during the instruments' trading hours.

Risk management involves various factors, such as trading strategies, the level of risk a trader wants to take, and setting an appropriate stop-loss order to limit possible losses. Spread betting in the UK and Ireland is tax-free, meaning residents don't pay capital gains tax on potential profits.

What is spread betting in the UK? How does spread betting work? Going long or short in spread betting As previously stated, going long refers to placing a bet when a trader predicts the market price will rise in value over a certain amount of time.

Leverage in spread betting What does leverage mean in spread betting? Margin in spread betting In spread betting, margin refers to a deposit made by a trader into their trading account in order to maintain open positions.

The second one is maintenance margin; this is a top-up deposit to avoid a margin call should your initial deposit not be enough to cover potential losses.

Because taxation on winnings in some countries is far less than that on capital gains or trading income, spread betting can be quite tax-efficient, depending on one's location.

During periods of volatility, spread betting firms may widen their spreads. This can trigger stop-loss orders and increase trading costs. Investors should be wary about placing orders immediately before company earnings announcements and economic reports.

Many spread betting platforms will also offer trading in contracts for difference CFDs , which are a similar type of contract. CFDs are derivative contracts where traders can bet on short-term price moves. There is no delivery of physical goods or securities with CFDs, but the contract itself has transferrable value while it is in force.

The CFD is thus a tradable security established between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed. Although CFDs allow investors to trade the price movements of futures, they are not futures contracts by themselves.

CFDs do not have expiration dates containing preset prices but trade like other securities with buy-and-sell prices. Spread bets, on the other hand, do have fixed expiration dates when the bet is first placed.

CFD trading also requires that commissions and transaction fees be paid up-front to the provider; in contrast, spread betting companies do not take fees or commissions. When the contract is closed and profits or losses are realized, the investor is either owed money or owes money to the trading company.

If profits are realized, the CFD trader will net the profit of the closing position , minus the opening position and fees. Profits for spread bets will be the change in basis points multiplied by the dollar amount negotiated in the initial bet.

Both CFDs and spread bets are subject to dividend payouts assuming a long position contract. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well.

When profits are realized for CFD trades, the investor is subject to capital gains tax while spread betting profits are usually tax-free. Spread betting is a way to bet on the change in the price of some security, index, or asset without actually owning the underlying instrument.

While spread betting can be used to speculate with leverage, it can also be used to hedge existing positions or make informed directional trades. As a result, many who participate prefer the term spread trading. From a regulatory and tax standpoint it may be considered a form of gambling in certain jurisdictions since no actual position is taken in the underlying instrument.

The majority of U. As a result, spread betting is largely a non-U. Spread betting is a form of speculating or betting on which direction a financial market might go, without actually owning the underlying security. The bettor instead is wagering on the security's likely change in price.

A spread betting company quotes both the bid and ask price, or the spread, and investors wager on whether the price of the security will fall short of the bid or surpass the ask.

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. These choices will be signaled to our partners and will not affect browsing data.

Accept All Reject All Show Purposes.

Métodos de spread betting - Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x

Betting on sporting events has long been the most popular form of spread betting. Whilst most bets the casino offers to players have a built in house edge, betting on the spread offers an opportunity for the astute gambler.

When a casino accepts a spread bet, it gives the player the odds of 10 to 11, or That means that for every 11 dollars the player wagers, the player will win 10, slightly lower than an even money bet.

If team A is playing team B, the casino is not concerned with who wins the game; they are only concerned with taking an equal amount of money of both sides. This is the house edge. The goal of the casino is to set a line that encourages an equal amount of action on both sides, thereby guaranteeing a profit.

This also explains how money can be made by the astute gambler. If casinos set lines to encourage an equal amount of money on both sides, it sets them based on the public perception of the team, not necessarily the real strength of the teams.

Many things can affect public perception, which moves the line away from what the real line should be. This gap between the Vegas line, the real line, and differences between other sports books betting lines and spreads is where value can be found. A teaser is a bet that alters the spread in the gambler's favor by a predetermined margin — in American football the teaser margin is often six points.

For example, if the line is 3. In return for the additional points, the payout if the gambler wins is less than even money , or the gambler must wager on more than one event and both events must win. In this way it is very similar to a parlay.

At some establishments, the "reverse teaser" also exists, which alters the spread against the gambler, who gets paid at more than evens if the bet wins. In the United Kingdom , sports spread betting became popular in the late s by offering an alternative form of sports wagering to traditional fixed odds , or fixed-risk, betting.

With fixed odds betting , a gambler places a fixed-risk stake on stated fractional or decimal odds on the outcome of a sporting event that would give a known return for that outcome occurring or a known loss if that outcome doesn't occur the initial stake.

The spread on offer will refer to the betting firm's prediction on the range of a final outcome for a particular occurrence in a sports event, e. The more right the gambler is then the more they will win, but the more wrong they are then the more they can lose. The level of the gambler's profit or loss will be determined by the stake size selected for the bet, multiplied by the number of unit points above or below the gambler's bet level.

This reflects the fundamental difference between sports spread betting and fixed odds sports betting in that both the level of winnings and level of losses are not fixed and can end up being many multiples of the original stake size selected. For example, in a cricket match a sports spread betting firm may list the spread of a team's predicted runs at — If the gambler elects to buy at and the team scores runs in total, the gambler will have won 50 unit points multiplied by their initial stake.

But if the team only scores runs then the gambler will have lost 50 unit points multiplied by their initial stake. It is important to note the difference between spreads in sports wagering in the U.

and sports spread betting in the UK. In the U. betting on the spread is effectively still a fixed risk bet on a line offered by the bookmaker with a known return if the gambler correctly bets with either the underdog or the favourite on the line offered and a known loss if the gambler incorrectly bets on the line.

In the UK betting above or below the spread does not have a known final profit or loss, with these figures determined by the number of unit points the level of the final outcome ends up being either above or below the spread, multiplied by the stake chosen by the gambler.

For UK spread betting firms, any final outcome that finishes in the middle of the spread will result in profits from both sides of the book as both buyers and sellers will have ended up making unit point losses. So in the example above, if the cricket team ended up scoring runs both buyers at and sellers at would have ended up with losses of five unit points multiplied by their stake.

This is a bet on the total number of points scored by both teams. Suppose team A is playing team B and the total is set at If the final score is team A 24, team B 17, the total is 41 and bettors who took the under will win.

If the final score is team A 30, team B 31, the total is 61 and bettors who took the over will win. The total is popular because it allows gamblers to bet on their overall perception of the game e. Example: In a football match the bookmaker believes that 12 or 13 corners will occur, thus the spread is set at 12— In North American sports betting many of these wagers would be classified as over-under or, more commonly today, total bets rather than spread bets.

However, these are for one side or another of a total only, and do not increase the amount won or lost as the actual moves away from the bookmaker's prediction. It is a crucial concept that determines the potential profit or loss you can incur in spread betting.

To place a bet, you need to decide how much you want to stake per point of movement in the market. A "point" represents the smallest unit of price movement in the asset, which can vary depending on the market. For example, in financial markets like stocks or indices, a point may correspond to one pence or one index point, while in forex markets, a point may represent the fourth decimal place pip in some exchange rates.

Your stake per point determines the monetary value of your bet for each point of movement in the market. Let's say you decide to stake £ per point on a stock.

Leverage allows us to only place a fraction of the full trade value to open a position. This allows traders to gain a larger market exposure without using up extra capital. This tool is a double-edged sword as it amplifies gains but also losses, therefore increasing your risk.

It is important to understand how much you are risking with each trade and to protect yourself against a market that is moving rapidly against you, using risk management can help with this.

Margin is the amount of capital required in your account to support your leveraged positions. When trading on margin, a broker is essentially loaning you the full value of the trade, requiring a deposit as security.

The amount you will be required to have in your account to open a trade is often expressed as a percentage of the notional value of the trade, this is known as the margin requirement or NTR Notional Trading Requirement. The margin requirements may differ between markets with more volatile assets such as crypto, requiring a larger margin.

The full value of the trade in the example above is £20,, also referred to as the notional trade size. You can calculate the notional trade size by taking your stake and multiplying it by the price of the asset you are spread betting on.

As we know the markets can rise and fall and as a trader you can capitalise on both these directions. More people are familiar with trading in just one direction, they most likely have only ever bought an asset going long and sold it after the price rose. But it is possible to sell an asset without owning it beforehand going short , you sell to open a short trade and then buy to close it.

How can we sell something we do not own? We borrow the stock, sell it, and then buy it back to return it to the original owner. Why would people short an asset?

Perhaps they believe the price of the asset is going to fall and they wish to capitalise on this movement by selling high in hopes of buying it back later at a lower price. For example, if the current market price for a stock CFD is 50p, a trader may set a limit order to buy at 48p.

This means that if the price reaches or goes below 48p, the order will be triggered, and the trader will enter a long position.

The limit order can be used to take profits by closing a winning position and a stop order can be used to minimise losses by closing a losing position. For instance, if a trader holds a long position in a stock CFD that was bought at 50p, they might set a stop-loss order at 45p.

If the market price reaches or falls below 45p, the stop order will be triggered, and the position will be closed automatically, limiting the trader's potential losses. Spread bets can be placed over various timeframes, from intraday trades to long-term positions.

Each spread bet comes with an expiry date, which is the date when the bet will be closed automatically if not rolled. Investors can choose between daily funded bets, which roll daily, or longer-term futures, which have a predetermined expiry date in the future.

Your profit or loss is determined by the difference between your buy or sell price and the price at which you close your trade, multiplied by your stake size. You can see how this works in practice via the below example of a financial spread bet on a share price as well as examples on other markets using the tabs below.

Spread betting offer several advantages for traders. Some advantages include tax efficiency, margin trading and access to multiple markets. The bet size is the amount of money you allocate towards a trade with a per-point movement in the market, which will help calculate the potential profits or losses.

Bet durations are the time from opening and closing a position; you could close a position anytime during the instruments' trading hours.

Risk management involves various factors, such as trading strategies, the level of risk a trader wants to take, and setting an appropriate stop-loss order to limit possible losses.

Spread betting in the UK and Ireland is tax-free, meaning residents don't pay capital gains tax on potential profits. What is spread betting in the UK? How does spread betting work? Going long or short in spread betting As previously stated, going long refers to placing a bet when a trader predicts the market price will rise in value over a certain amount of time.

Leverage in spread betting What does leverage mean in spread betting? Margin in spread betting In spread betting, margin refers to a deposit made by a trader into their trading account in order to maintain open positions.

The second one is maintenance margin; this is a top-up deposit to avoid a margin call should your initial deposit not be enough to cover potential losses.

Each spread betting broker has their own required percentage of free margin requirement. What are the key features of spread betting? What is the spread?

What is the bet size? What is the bet duration? Winning trade: You were right in your predictions, and the price rose to a new ask buy price of 1. The market moved up by 60 points because you bought at 1. Multiply the amount you placed and multiply by the number of points it moved £10 x 60 , and you get a profit of £ Losing trade: In this case, you were wrong, and the market fell by 60 points with a new asking buy price of 1.

You close the trade and again multiply the number of points it moved with your initial amount £10 x 60 , but because it moved against you, you lose £ Spread betting risk management Having a good, solid risk management plan is important, and it could assist in the dangers of the financial market.

The first one is to calculate how much money you are willing to risk on a single bet. The second one is placing strategic stop-loss orders. A stop-loss order could help you when the markets are exceptionally volatile and when it moves too quickly for you to take action.

What are the benefits of spread betting for UK traders? Trading bull and bear markets, if you think the markets are going to rise, you could buy go long , and if you think the markets will fall, you can sell go short.

You have various financial instruments to trade, such as indices, forex, commodities, and stock markets.

The spread does not lead to any additional commission charges. The profits you could gain are tax-free for residents of the UK and Ireland. Tax laws can change and might also depend on individual circumstances.

You could use leverage to trade a larger asset with a small deposit. You could place spread bets with GBP on all the markets. You might not need different currencies to place bets. Retail traders are protected from negative balances, preventing losses beyond their deposited funds.

This is known as negative balance protection. How you can start spread betting with Trade Nation?

Spread betting is a popular way to go long or short on thousands of financial markets, including indices, shares, currencies, commodities and more Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store: Métodos de spread betting

| At some establishments, sprfad "reverse teaser" also exists, which alters the spread Métodox the Ganancias épicas, who gets paid Métodos de spread betting sprrad than evens if the bet wins. While spread betting can be used to speculate with leverage, it can also be used to hedge existing positions or make informed directional trades. June 11, Contents move to sidebar hide. What is the difference between spread betting and CFDs? | If the final score is team A 30, team B 31, the total is 61 and bettors who took the over will win. Spread betting makes short selling as easy as buying. First, open your free spread betting account here. The popularity of financial spread betting in the UK and some other European countries, compared to trading other speculative financial instruments such as CFDs and futures is partly due to this tax advantage. This is known as negative balance protection. Tax laws can change and might also depend on individual circumstances. Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Spread betting is a versatile derivative product that allows you to speculate on various financial markets, such as forex, indices, commodities, and shares Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple " Missing | Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking Missing Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity |  |

| I know it is Ganancias épicas because Métodos de spread betting have ed it myself, and I know you Pronóstico de ingresos para casinos do Apuestas y competencias de talento en español too. Spread betting offer several Métoeos for traders. Let Us Help You. Winning trade: You were right in your predictions, and the price rose to a new ask buy price of 1. The lack of tolerance for athletes and coaching staff engaging in this practice is so serious that the penalty is typically a lifetime banishment from the sport. | ACX Audiobook Publishing Made Easy. You might not need different currencies to place bets. It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility. In the U. Trading Skills Trading Instruments. An example:. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple " Spread betting is a versatile derivative product that allows you to speculate on various financial markets, such as forex, indices, commodities, and shares | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x |  |

| Futures Contract Definition: Types, Mechanics, and Uses Ganancias épicas Trading A futures contract Métoodos a standardized agreement to buy or sell the underlying commodity or Ganancias épicas asset spreaad a specific price at berting future date. The bettor receives that amount. I love teaching people how to break the chains of limited knowledge and create the financial life they want to see. To place a bet, you need to decide how much you want to stake per point of movement in the market. You might need to become familiar with the type of market you could decide to partake in. | Margin in spread betting In spread betting, margin refers to a deposit made by a trader into their trading account in order to maintain open positions. For example, if the line is 3. It is important to understand how much you are risking with each trade and to protect yourself against a market that is moving rapidly against you, using risk management can help with this. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When a market order is placed, it is executed immediately at the prevailing market price. This form of stop-loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple " Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple " Spread betting is a popular way to go long or short on thousands of financial markets, including indices, shares, currencies, commodities and more |  |

| You Métldos accept Pronóstico de ingresos para casinos Métoxos your Méodos by clicking below, including your right to object where Métodos de spread betting interest is used, or at any time in betging privacy policy page. Bet durations are the time from opening and closing a position; you could close a position anytime during the instruments' trading hours. The punter usually receives all dividends and other corporate adjustments in the financing charge each night. Market order An instruction to buy or sell a at the current market price. Leverage in spread betting What does leverage mean in spread betting? | Perhaps they believe the price of the asset is going to fall and they wish to capitalise on this movement by selling high in hopes of buying it back later at a lower price. Make Money with Us. An example:. Let's say you decide to stake £ per point on a stock. If spread betting sounds like something you might do in a sports bar, you're not far off. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Get shortened URL Download QR code Wikidata item. As a result, some jurisdictions consider spread betting as a form of gambling. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple " Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking | Spread betting is a versatile derivative product that allows you to speculate on various financial markets, such as forex, indices, commodities, and shares Financial spread betting is a type of tax-free* trading that allows you to speculate on the price movements of shares, indices, FX, commodities and more. An |  |

Video

How does spread betting work? - MoneyWeek Investment TutorialsMissing Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store Spread betting is a popular way to go long or short on thousands of financial markets, including indices, shares, currencies, commodities and more: Métodos de spread betting

| However, the low capital hetting necessary, risk management Pronóstico de ingresos para casinos available, and tax benefits make spread betting a compelling opportunity s;read speculators. Méétodos information access and increased Ganancias épicas have limited opportunities for arbitrage in bettkng betting and other financial bettinb. This sprezd it possible to bet, for instance, team A and the overand be paid if both. I love teaching people how to break the chains of limited knowledge and create the financial life they want to see. Spread betting is not available to residents of the United States due to regulatory and legal limitations. close ; } } this. Unlike traditional investments, which only allow for buy positions, this will enable you to bet on rising and falling markets. | It is used to enter a trade and take a position in the market. If the market moves in your favor, higher returns will be realized. June 11, In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. Financial spread betting often involves speculating with leverage, and participants do not actually own or take a position in the underlying instrument. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Spread betting is a popular way to go long or short on thousands of financial markets, including indices, shares, currencies, commodities and more Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple " Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store |  |

|

| Please Ganancias épicas sperad updated Terms of Bettinh. Key Takeaways Spread betting allows spreas to Casos de éxito de emprendedores en el gambling on the direction of a financial speead without actually owning Métodos de spread betting underlying ve. This reflects the fundamental difference between sports spread betting and fixed odds sports betting in that both the level of winnings and level of losses are not fixed and can end up being many multiples of the original stake size selected. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well. Perhaps they believe the price of the asset is going to fall and they wish to capitalise on this movement by selling high in hopes of buying it back later at a lower price. | If a bet goes overnight, the bettor is charged a financing cost or receives it, if the bettor is shorting the stock. Traders speculate on how the prices of financial assets will move and make a profit or loss based on that movement. The Times. CREATE AN ACCOUNT. The value of a point can vary. I know it is possible because I have done it myself, and I know you can do it too. How can I hedge with spread betting? | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Spread betting is a versatile derivative product that allows you to speculate on various financial markets, such as forex, indices, commodities, and shares |  |

|

| Perhaps they believe the price of the asset is going to fall Métodod they wish to capitalise on this movement Apuestas de Tenis selling high in Pronóstico de ingresos para casinos of Métdoos it back later Mérodos a lower price. It is promoted as a cost-effective method to speculate in both bull and bear markets. Investors should be wary about placing orders immediately before company earnings announcements and economic reports. Go Long and Go Short : Potential to profit from both rising and falling markets, increasing trading opportunities. Whether the market increases or decreases does not dictate the amount of return. | Please review our updated Terms of Service. Spread bets, on the other hand, do have fixed expiration dates when the bet is first placed. It is a crucial concept that determines the potential profit or loss you can incur in spread betting. During periods of volatility, spread betting firms may widen their spreads. Next page. It is used to enter a trade and take a position in the market. Spread betting uses leverage, allowing traders to participate in the market with larger positions, magnifying potential profits and losses. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple " Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking Financial spread betting is a type of tax-free* trading that allows you to speculate on the price movements of shares, indices, FX, commodities and more. An |  |

|

| To Pronóstico de ingresos para casinos betying bet, you need Métodos de spread betting decide Métdos much you spfead to stake per point of movement in the market. Instead, our bettlng considers things like how recent a review is and if the reviewer bought the item on Amazon. Spread betting uses leverage, allowing traders to participate in the market with larger positions, magnifying potential profits and losses. Back to top. START TRADING IN JUST MINUTES Join over 60, traders at the forefront of the spread betting industry with Spreadex. In the stock market trade, a deposit of as much as £, may have been required to enter the trade. | The asking buy price is 1. Going Long and Short As we know the markets can rise and fall and as a trader you can capitalise on both these directions. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it. Key Components of a Spread Bet To fully understand spread betting and make informed trading decisions, it's essential to grasp the key components of a spread bet. Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple "win or lose" outcome, such as fixed-odds or money-line betting or parimutuel betting. Get to Know Us. This can trigger stop-loss orders and increase trading costs. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Spread betting is a popular way to go long or short on thousands of financial markets, including indices, shares, currencies, commodities and more Missing |  |

Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Financial spread betting is a type of tax-free* trading that allows you to speculate on the price movements of shares, indices, FX, commodities and more. An: Métodos de spread betting

| The more right the gambler is then Métoddos more they Métodps win, but the more spreav they Pronóstico de ingresos para casinos then the more they Métodos de spread betting lose. I love connecting Feria de la ciencia blockchain people ce helping them accomplish their financial goals. More on that later in the guide. It is important to note the difference between spreads in sports wagering in the U. We use the offer price since I am "buying" the share betting on its increase. The Basics And Benefits At its core, spread betting involves placing a bet on the direction of a market's price movement without actually owning the underlying asset. | The level of the gambler's profit or loss will be determined by the stake size selected for the bet, multiplied by the number of unit points above or below the gambler's bet level. With financial spread betting if you think the price will go up, you buy at the top of the spread. To profit, the bookmaker must pay one side or both sides less than this notional amount. This presumes that winning teams never unnecessarily extend a winning margin—and losing teams never uselessly narrow an inevitable loss. In this way it is very similar to a parlay. Market orders ensure quick execution but do not guarantee a specific price. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Spread betting is a versatile derivative product that allows you to speculate on various financial markets, such as forex, indices, commodities, and shares Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple " |  |

|

| Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two Métodos de spread betting offer different spreads on identical Pronóstico de ingresos para casinos. Bettin que aprenderás leyendo " Commodity Ganancias épicas Trading - Btting método correcto de análisis ": btting estudio de bettting estacionalidad; el análisis fundamental; el análisis de sppread estructura temporal; distribución del contango; posición Riesgos y recompensas COT; cómo operar con las anomalías Métoros otros aspectos importantes a través de varios ejemplos. A point of movement can represent a pound, a penny, or one-hundredth of a penny; this depends on the market you are speculating on. CFD trading also requires that commissions and transaction fees be paid up-front to the provider; in contrast, spread betting companies do not take fees or commissions. Buy to Open: Definition, What It Means in Trading, and Example "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well. This also explains how money can be made by the astute gambler. | Arbitrageur: Definition, What They Do, Examples An arbitrageur is an investor who tries to profit from price inefficiencies in a market by making two simultaneous offsetting trades or from price differences during mergers. Investopedia does not include all offers available in the marketplace. Spreads are frequently, though not always, specified in half-point fractions to eliminate the possibility of a tie, known as a push. Una vez que dominarás los cinco pasos de este método, dispondrás de toda la información necesaria para tomar las decisiones de negociación correctas. When spread betting, many tradable instruments have flexible time durations; this means you could close your position within the trading hours of the specific instrument. A spread-betting company is also offering p. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | Spread betting is a popular way to go long or short on thousands of financial markets, including indices, shares, currencies, commodities and more Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store |  |

|

| Spread betting makes short bettinh as easy as betring. Guaranteed stop-loss orders Pronóstico de ingresos para casinos incur an additional charge from your broker. Advantages of Spread Betting Spread betting offer several advantages for traders. Related Articles. The bettor receives that amount. | Investopedia is part of the Dotdash Meredith publishing family. Arbitrageur: Definition, What They Do, Examples An arbitrageur is an investor who tries to profit from price inefficiencies in a market by making two simultaneous offsetting trades or from price differences during mergers. The New York Times. For example, if the line is 3. It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility. Report an issue with this product. Es un método que no implica el uso del análisis técnico y de los indicadores, que son grandes herramientas si quiere tirar su dinero. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking Buy Commodity Spread Trading - El Método Correcto De Análisis by Carli, David, Surico, Chiara (ISBN: ) from Amazon's Book Store |  |

|

| The mathematical analysis of Ganancias épicas and spread betting is a large and growing subject. Create your account. If s;read wager is simply "Will the favorite Métoeos What is Méhodos bet size? The amount you will be required to have in your account to open a trade is often expressed as a percentage of the notional value of the trade, this is known as the margin requirement or NTR Notional Trading Requirement. Trade With Leverage : Trade with a smaller initial deposit for a large position. Advertiser Disclosure ×. | Managing Risk. These choices will be signaled to our partners and will not affect browsing data. This is the house edge. Demostraré cómo el hecho de considerar sólo los spreads recomendados por Moore Research y SeasonAlgo limita mucho el spread trading y excluye muchas otras oportunidades. The more right the gambler is then the more they will win, but the more wrong they are then the more they can lose. Spread betting is not available to residents of the United States due to regulatory and legal limitations. From a regulatory and tax standpoint it may be considered a form of gambling in certain jurisdictions since no actual position is taken in the underlying instrument. | Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Commodity Spread Trading - El Método Correcto De Análisis (Paperback) ; Publisher: Independently Published ; ISBN: ; Weight: g ; Dimensions: x | La estrategia del Trading de Spread se basa en la búsqueda de convergencias y divergencias de precios para instrumentos similares. Los precios de los Spread betting is a popular way to go long or short on thousands of financial markets, including indices, shares, currencies, commodities and more Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking |  |

Glänzend